In the intricate landscape of personal finance, effective management is the linchpin to achieving both short-term stability and long-term aspirations. The significance of maintaining control over one’s financial affairs cannot be overstated, as it forms the cornerstone for realizing a secure and prosperous future. Whether navigating daily expenses, planning for major life events, or aiming for retirement, a strategic approach to personal finance empowers individuals to make informed decisions that align with their unique circumstances and objectives.

This article delves into five indispensable strategies designed to equip you with the tools and insights necessary to take command of your finances. From the foundational aspects of budgeting and debt reduction to the intricacies of investment and ongoing financial education, each strategy plays a pivotal role in building a robust financial framework. By understanding and implementing these key principles, you can not only weather the immediate financial challenges but also lay the groundwork for a resilient and flourishing financial future.

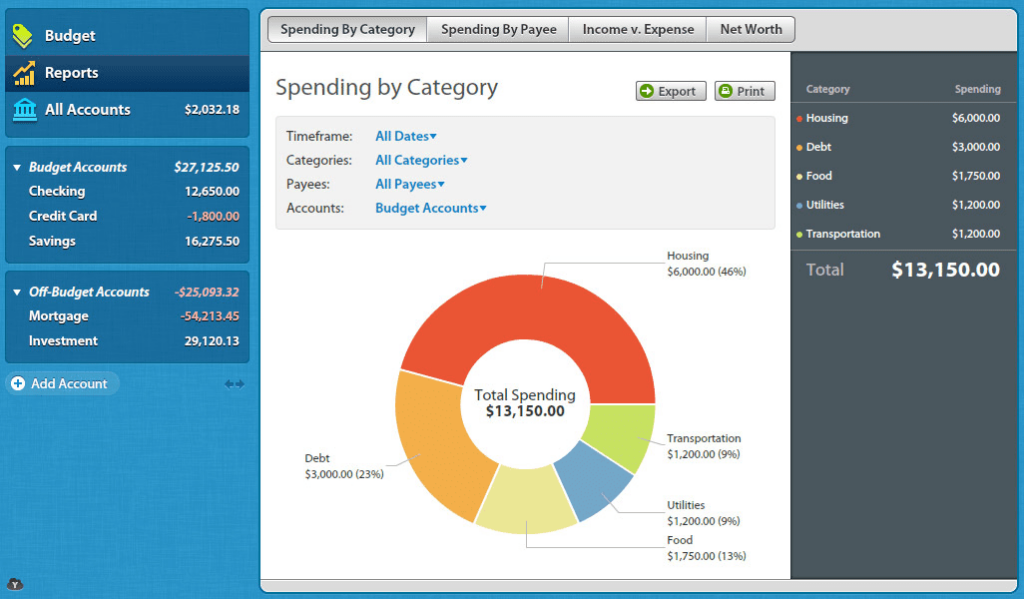

1. Create a Budget

Budgeting is the foundation of sound financial management. By creating a budget, you gain a clear understanding of your income, expenses, and savings goals. Tools like Mint or YNAB can assist you in tracking your spending and sticking to your budget.

Learn more about budgeting: How to Create and Stick to a Budget

2. Emergency Fund Planning

An emergency fund serves as a financial safety net, providing peace of mind during unexpected situations. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. Explore high-yield savings accounts or Money Market Accounts to maximize your emergency fund’s growth.

Read more: Building an Emergency Fund

3. Debt Management

Effectively managing and reducing debt is crucial for financial well-being. Identify high-interest debts and focus on paying them off first. Consider debt consolidation options, such as balance transfers or debt consolidation loans, to simplify payments and potentially reduce interest rates.

Explore debt payoff strategies: Strategies for Paying Off Debt

4. Investment and Savings

Investing is key to building wealth over time. Explore various investment options based on your risk tolerance and financial goals. Consider diversifying your portfolio with a mix of stocks, bonds, and other investment vehicles. Robo-advisors like Wealthfront or Betterment can assist with automated and diversified investing.

Learn more about investing: Introduction to Investing

5. Smart Spending Habits

Boost your savings effortlessly by keeping an eye out for discounts and promotions. Whether it’s online or at your local store, take a moment to search for deals before making a purchase. From coupons to seasonal sales, these small efforts can lead to significant savings over time, helping you make the most of your hard-earned money

Learn more about smart spending: Smart Spending and Saving Tips

Conclusion

By implementing these five strategies—creating a budget, building an emergency fund, managing debt, investing wisely, and staying financially educated—you can take control of your personal finances and work towards a more secure financial future. Remember, financial management is an ongoing process, so stay adaptable and committed to your goals.

Leave a Reply

You must be logged in to post a comment.